In a groundbreaking move that has captured the attention of tech enthusiasts and investors alike, Nvidia has announced its acquisition of two pioneering AI companies. This strategic decision has the potential to significantly bolster Nvidia’s position in the AI industry, ushering in new opportunities for innovation and growth. In this blog post, we’ll explore the implications of these acquisitions, the potential impacts on the market, and what investors need to know to make informed decisions.

Understanding Nvidia’s Strategy

Nvidia’s decision to acquire these AI-driven companies underscores its commitment to staying at the forefront of technology. The company’s strategy revolves around:

- Expanding its AI capabilities: These acquisitions allow Nvidia to integrate innovative AI technologies into its existing platforms.

- Enhancing product offerings: By incorporating new AI-driven solutions, Nvidia can deliver more robust products and services to its customers.

- Gaining a competitive edge: Strengthening its AI portfolio helps Nvidia maintain a competitive edge in a rapidly evolving market.

The Companies Acquired

Company 1: Nebius Group

Nebius Group is renowned for its cutting-edge machine learning algorithms and neural networks. This acquisition will enable Nvidia to:

- Improve the efficiency of its AI models

- Enhance the performance of its data processing capabilities

- Leverage ABC AI’s proprietary technologies to develop new AI applications

Company 2: WeRide

WeRide specializes in AI-driven robotics solutions, positioning Nvidia to capitalize on:

- Innovative robotic technologies for autonomous vehicles

- Streamlining manufacturing processes through robotic automation

- Expanding its footprint in the robotics industry with cutting-edge AI solutions

Impact on the Market

These acquisitions are likely to have a significant impact on the market. Here’s what investors should consider:

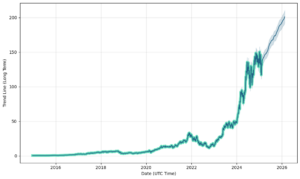

- Increased demand for Nvidia products: As Nvidia expands its AI capabilities, demand for its products is expected to rise, potentially leading to increased revenue.

- Heightened competition: The acquisition of AI companies could prompt competitors to enhance their own offerings, intensifying competition in the AI space.

- Market volatility: While Nvidia’s strategic move is promising, market volatility could affect stock prices in the short term.

Investment Opportunities and Risks

For those considering investing in Nvidia, understanding the potential opportunities and risks is essential:

- Opportunities:

- Capitalizing on the growing AI market

- Leveraging Nvidia’s expanded AI portfolio

- Benefiting from increased product demand

- Risks:

- Market volatility impacting stock prices

- Unanticipated challenges in integrating new technologies

- Potential changes in AI regulations and policies

Conclusion

Nvidia’s acquisition of Nebius Group and WeRide represents a bold step forward in its quest to lead the AI revolution. With increased capabilities, Nvidia is poised to make significant advancements across several sectors, potentially driving investor interest and market growth. However, potential investors should weigh the opportunities against the inherent risks while keeping an eye on market dynamics.

As you explore these developments and consider their implications, ensure you’re well-informed to make strategic investment decisions.